MONROVIA – The Central Bank of Liberia is caught in the web and now has the responsibility of vindicating itself from allegations of entrenched systemic flaws exposed by the General Auditing Commission (GAC) report on the controversial US$25 million taken from the country’s foreign reserves to mop up excess liquidity.

The ineffectiveness of the mop exercise raised suspicions of embezzlement on the part of the Technical Economic Management Team (TEMT) which is headed by Finance Minister Samuel Tweah and co-chaired by the Governor of the Central Bank, Nathaniel Patray, III.

But the GAC audit which was commissioned by President George Weah uncovered discrepancies in the mopping process and blamed the CBL for all the variances and unexplained discrepancies during the exercise.

Contrary to the popular belief that the money was embezzled, Justice Minister, Frank Musa Dean, in response to the report said, not a penny was missing from the US$25 million.

“There is, therefore, no issue as to the L$2.6 billion, representing the value of US$17M, being brought to the vault of the Central Bank of Liberia (CBL). It can safely be concluded that, no money is missing in the US$25 million mop-up exercise,” the Justice Minister said in count six of his “Response to the Auditor General’s Report on Factual Findings on the US$25 Mop-up Exercise Conducted by the Central Bank of Liberia,” Min. Dean said.

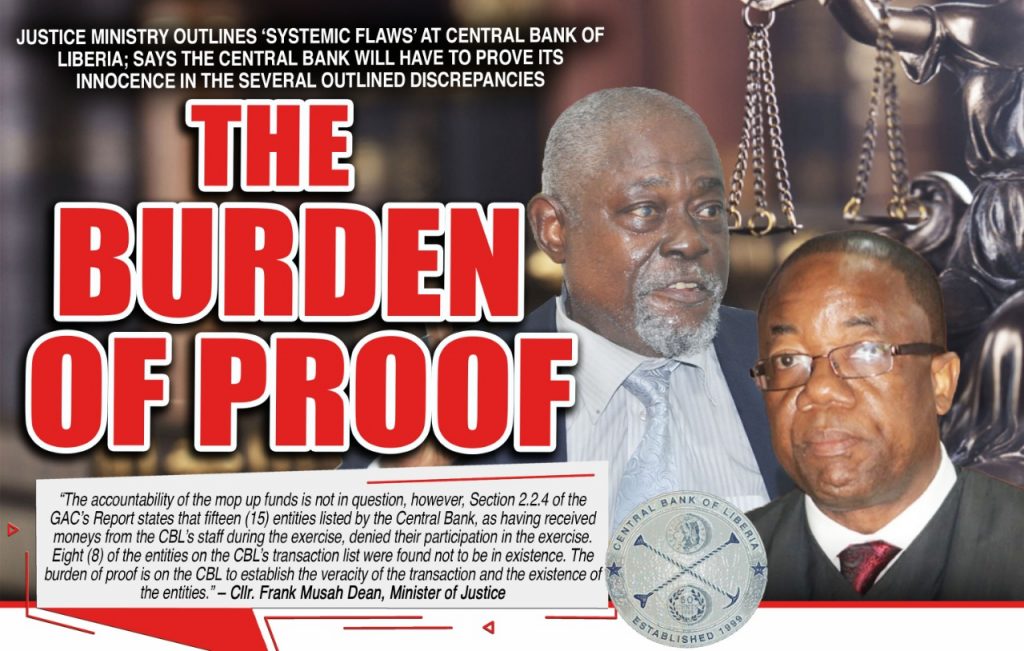

Though the Justice Minister is confident that not a cent was missing, he outlined issues discovered which he believes the Central Bank would have to respond to. “The accountability of the mop funds is not in question,” he said. “However, Section 2.2.4 of the GAC’s Report states that 15 entities listed by the Central Bank of Liberia, as having received moneys from the CBL’s staff during the exercise denied their participation in the exercise. Eight of the entities listed on the CBL’s transaction list were found not be in existence. The burden of proof is on the CBL to establish the veracity of the transactions and the existence of the entities.”

The Justice Minister in a press briefing on Wednesday said multiple sections of the report referenced discrepancies and variances in the accounting records of the mop up exercise. “These variances and discrepancies place the burden of proof on the CBL to explain these variances and discrepancies or to establish that they are not factual,” he added.

The Auditor General, Yusador Gaye, in her cover letter of the report submitted to Attorney General Frank Musah Dean noted: “The meetings’ minutes of TEMT (The Economic Management Team) showed that TEMT mandated CBL to carry out the mop up exercise and also authorized the CBL to re-infuse the mopped-up funds into the economy. More importantly, Section 1.1.9 Part II, count 4 of the findings cites the CBL Act as requiring that the CBL to have “functional independence, power and authority to conduct foreign exchange operations.”

Governor Patray, according to the findings, indicated to the GAC through a documented review questionnaire that the mop-up exercise was authorized by The Economic Management Team. However, the Chairman of TEMT, Finance and Economic Planning Minister Samuel D. Tweah indicated to the GAC that the TEMT did not issue the CBL a written instruction for the mop-up exercise; rather, the mop-up strategy was authorized by TEMT.

Minister Tweah indicated in his documented interview questionnaire that TEMT authorized the CBL to re-infuse the mopped-up Liberian Dollars into the market through the commercial banks and that, the TEMT and the CBL did not provide evidence of the authorization to re-infuse the mopped-up Liberian dollars into the economy as per the MOU.

Meanwhile, according to the GAC’s findings, a total of fifteen entities were listed by the CBL but those entities indicated that they did not participate in the Mop-Up exercise.

The companies are: Mari Empowerment in Brewerville, listed for $US5,000; ND Gobah, a small business in Duala, $US2,500; Siapondo, a FX Bureau on SKD Blvd, $6,000; Nadhel, a business in Paynesville, $18,463.00, Alpha Kilo, an FX Bureau on 3rd Street, Saye Town, $18,500.00; Songhay Travel Agency, a business between Carey and Buchanan Street, $41,400.00; Dickson, an FX Bureau on Johnson Street, 3,000.00; Unitrans, FX Bureau on Newport Street, $2,500.00; Misside Pella, a Provision shop in Rally Town Market, $9,000, Petro One, listed as a major importer on Bushrod Island, $100,000.00; RITCO, a business in Clara Town, $3,250.00; Blue Link, an FX Bureau on Camp Johnson Road, $23,451.00; AbiJaoudi Azar, $253,705.00; National Association/Sabou Cisse FX Bureau, $23, 451.00 and Sure Success at 72nd, $2,500.00. The total amount reportedly disbursed is set at $491,769.00

Additionally, the report found twenty-seven entities listed as participating in the Mop-Up exercise per CBL records but were not registered per Liberia Business Registry Records amounting to US$702,680.00.

Another fifty-two entities participated in the mop-up exercise per CBL records but did not answer or reply to telephone calls and text messages. That amounts to 1,092,292.00. Eight entities also participated per CBL Records in the mop-up exercise but were not in operation when during the field visit.

According to the GAC, the Banking Department of the CBL disbursed the United States Dollars in the ratios of 51.8% to Fx bureaus and the remaining 48.2% to major importers and small businesses contrary to the approved recommendation. “The Auditors confirm the names, entities, telephone numbers, locations and amount transacted with the beneficiaries to determine the legitimacy and accuracy of the transactions.”

Section 3.1.2 of the report states: “There was also a variance of L$108,928,788.37 between the amounts in the summary Liberian Dollar Report per beneficiary presented by the CBL and the amount confirmed by the beneficiaries.”

In another discrepancy, the GAC said the CBL Special Liberian Dollars Mop-Up Escrow Account showed that the amount of LR$ 2,303,363,898.00 was transferred to the Operational Vault of the CBL whereas the CBL Press Statement dated March 5, 2019 indicated that L$1,300,000,000.00 was transferred from Liberia Dollars Special Escrow Account to the operational vault for re-infusion into the economy.

The CBL issued a memo for the opening of a special mop-up exercise Escrow Account on July 19, 2018 three days after the commencement of the exercise. But an examination of the bank statement of the Special Liberian Dollars Escrow Account showed that the initial deposit into the account occurred on August 17, 2018 a month after the commencement of the exercise.

Source: frontpageafricaonline.com